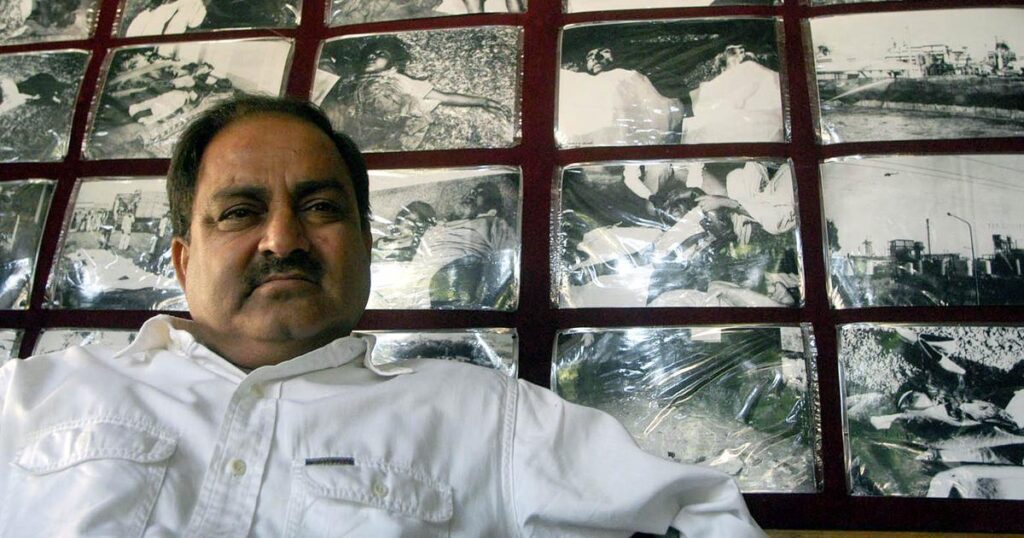

Rehan Yar Khan is one of India’s most prolific angel investors . Known as the trend spotter and an entrepreneur himself (founder of Flora2000.com), Rehan Yar Khan started investing back in 2007-08. He was one of the earliest investors in companies like Druva and Ola Cabs that have gone on to raise more than $100 million together. Rehan has more than 20 investments and now, he has raised the first formal fund of INR 300 cores- Orios Venture Partners (read our interview with Rehan back in 2012). Work has been on with respect to the Orios Venture Fund for close to an year now.

While 30% of the fund was raised from institutional investors, majority 70% of the corpus has been raised from ultra high-networth individuals (UHNIs). Reports say that Khan who has personally contributed 5% of the corpus, and the promoters of a Delhi based listed auto manufacturer are said to be one of the anchors in the fund. The fund will be used to invest in Software Product companies. A majority of the total corpus will be set aside for later stage funding (series ‘A’ and ‘B’), while about 10-15 per cent will be reserved towards seed funding. “While we are not restricting to any segment, we see analytics, Big Data, software for mobile phones and new platforms to be promising,” Khan had mentioned in an interview.

Rehan has had many successful investments apart from Druva and Ola Cabs. There are companies like Jigsee (acquired), Sapience, Unbxd, Pretty Secrets, etc. in his portfolio. Khan says that Software products is 1% of our exports while the rest is services, but in the next 10 years products will be 10-20%, which will create some great companies. Orios will be investing INR 1-20 crores in a company and intends to stay invested for seven years or more. In our earlier interview, we asked Rehan about his advice to someone new who’s looking to pitch to him, here’s what he told us,

” It is very important that when you are going to a pitch event or for raising money, you should ideally study, like in college, or when you go for a job you should ideally study the employer you going to join. So when you go for raising funding, you should study the person you are raising funding from. You should study what works while raising funding, speak to a lot to other entrepreneurs, do a lot of research, attend few events and learn and go prepared. “

Website: Orios Venture Partners

source: http://www.yourstory.com / Home> Inspire, Innovate, Ignite / by Jubin Mehta / August 19th, 2014

Jubin Mehta

Jubin is an old timer at YourStory. Deeply entrenched in the Indian startup ecosystem, he has written about more than 1000 startups. With an engineering background and a keen interest in data analysis, his passion for writing and entrepreneurship makes him a perfect match for Yourstory. He operates from the mountains in Dharamshala where he also runs a hackbase. He can be reached on Twitter @jub_in and on mail at jubin@yourstory.com