NEW DELHI :

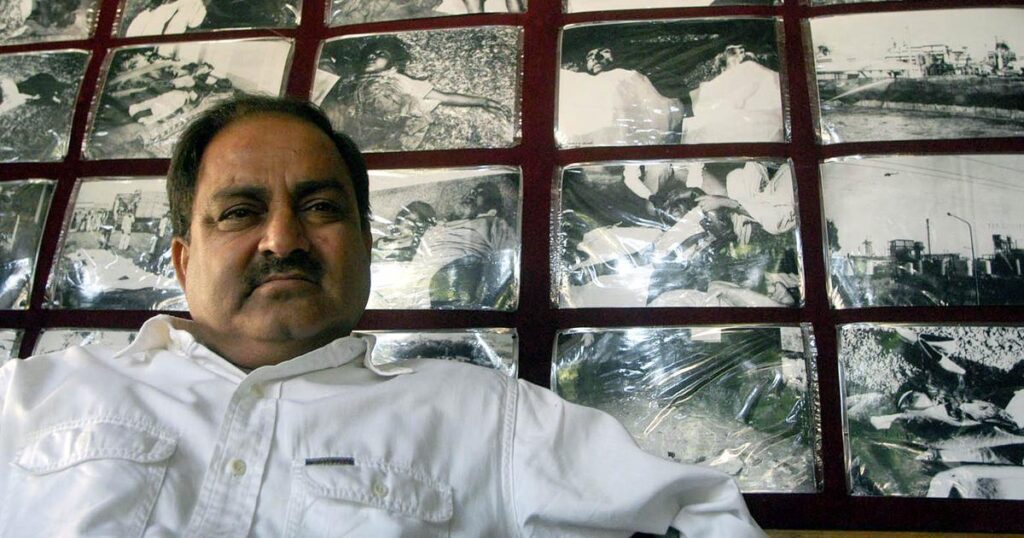

Member of Parliament Tariq Anwar speaking at the first year celebration of Sahyog credit co-operative society in Abul Fazal Enclave, Jamia Nagar, on February 23, 2025.

New Delhi :

Delhi’s Jamia Nagar-based Sahyog Credit Cooperative Society Ltd celebrated its first anniversary on Sunday, offering a comprehensive range of services, including Daily Deposit Accounts where daily wage earners and small businesses can deposit a minimum of Rs. 100 daily at their doorsteps, and providing interest-free loans and financial assistance ranging from Rs. 50,000 to Rs. 2 lakh under various personal consumption, consumer, and commercial loan schemes.

Sahyog is working under the nationwide Sahulat Microfinance Society, a game-changing initiative in the interest-free finance sector that operates in 13 states and has 130 branches serving 3.5 lakh members across the country.

Its first annual programme was held at Milli Model School in Okhla, New Delhi, with Congress MP Tariq Anwar speaking as the chief guest and attended by various local dignitaries and prominent personalities.

Sahulat’s Groundbreaking Work in Microfinance: A Beacon of Hope for Low-Income Families

Speaking at the event, Usama Khan, CEO of Sahulat Microfinance Society, highlighted the organization’s 14-year history of providing interest-free microfinance services across India. He shared that Sahulat currently has 63 registered interest-free credit cooperative societies affiliated with it, operating 121 branches across 13 states. These branches serve nearly 3.5 lakh members, with the number steadily increasing.

Usama further detailed its impressive figures, including annual deposits of approximately Rs. 1460 crores and annual loan disbursements of around Rs. 625 crores, both of which are doubling every year.

Emphasizing that Sahyog’s success is built on the strong foundation of Sahulat’s 14 years of experience, Usama said, “Sahyog’s journey is not just one year; it is backed by the proven track record of Sahulat’s nationwide operations.”

“Credit cooperative societies worldwide are supply-side models,” Usama said. “Similarly, Sahulat-affiliated societies help low-income individuals save a small portion of their income, whether from daily wages, small businesses, or other livelihoods, which, over time, can accumulate and be used for essential needs.”

Assuring the audience, Usama stressed that the foundations of Sahyog and other affiliated societies are robust, adhering to both Indian regulations and international microfinance standards. He also praised Sahyog’s office bearers, including President Shamsuz Zoha and Vice President, as trustworthy persons.

Defining Sahyog, Usama Khan explained that the society is registered under the Delhi Cooperative Societies Act as a credit cooperative society. It offers thrift schemes to its members, mobilizes deposits, and provides interest-free loans and financial assistance of up to Rs. 50,000 to meet the various consumption and business needs of small-income individuals in the Jamia Nagar locality, regardless of caste, class, or religion. Usama highlighted that Sahyog primarily serves small-scale businessmen and low-income people in areas such as Zakir Nagar, Batla House, Abul Fazal, Okhla Vihar, and Shaheen Bagh.

Usama further detailed Sahyog’s services, including the Daily Deposits Account. This initiative allows daily depositors, such as daily wage earners, shopkeepers, street vendors, and auto and cab drivers, to make deposits without leaving their workplaces or shops. Sahyog’s staff collects deposits directly from members’ homes, doorsteps, shops, or other locations, starting with a minimum of Rs. 100. Under this scheme, daily wage earners and small shop owners can deposit a minimum of Rs. 100 daily at their doorsteps. The service also provides e-receipts (via SMS) and passbooks for members.

For salaried individuals, working women, and both skilled and unskilled professionals, Sahyog offers a Saving Account with a minimum deposit of Rs. 200. This account is designed to cater to their future needs and is supported by deposit collection both in the field and at the branch office.

Micro Finance institution Backed by Strong Islamic Interest-free norms

Speaking about Sahyog’s interest-free loan offerings, Usama Khan outlined three types of loan schemes: Demand Loan, Consumer Murabaha Financing, and Commercial Murabaha Financing. He explained that the Demand Loan is specifically designed for consumption purposes, such as personal use, with a maximum tenure of 12 to 18 months. Under this scheme, Sahyog charges no interest or profit, not even based on depositor profits or institutional standards. Instead, the society only applies a minimal surcharge of 1-2%, covering the actual costs of office maintenance, such as doorstep collections, record keeping, and expenses related to core banking software and office staff.

Usama emphasized that Sahyog, as a non-banking institution, operates with core banking software to ensure transparency and efficiency in its operations.

Addressing concerns regarding the minimal surcharge being equated with interest, Usama firmly stated that all of Sahyog’s schemes strictly adhere to Islamic teachings, reinforcing the society’s commitment to providing interest-free financial services.

Usama made a heartfelt appeal to marginalized and low-income people, encouraging them to save and invest in the scheme to meet their daily needs. He also urged the affluent members of society to contribute resources and support this initiative to uplift those in need.

Sahyog: Expansion Plans and Promising Future

In a conversation with Indiatomorrow.net, Sahyog Vice President Abdul Mannan clarified that the society does not charge interest or fixed percentage fees on loans. Instead, it only recovers the actual costs associated with services like doorstep collections, office maintenance, and software upkeep. These costs are minimal, typically ranging from Rs. 500 to Rs. 2,000 per loan of 20-50 thousand. He also shared that Sahyog’s Jamia Nagar branch has been operating smoothly, with 750 members joining within its first year. The members have shown great cooperation, with loan repayments being made responsibly. Abdul Mannan revealed plans to expand Sahyog’s branches in different areas of Delhi and aimed to increase the membership to 1,000 by 2025.

Regarding the Consumer Murabaha Financing scheme, Abdul Mannan explained that it allows Sahyog to provide durable products to members for consumption. The loan repayment period ranges from 3 to 18 months, with amounts between Rs. 10,000 and Rs. 1 lakh. For example, if a member wants to purchase a refrigerator priced at Rs. 20,000, Sahyog buys the refrigerator at that price, and then negotiates a one-time profit share with the seller. The member then repays the exact Rs. 20,000 in easy instalments. Abdul Mannan emphasized that this profit is in compliance with Islamic teachings.

Abdul Mannan also introduced the upcoming Commercial Murabaha Financing scheme, which will provide commercial products to members. Loans for these products will range from Rs. 10,000 to Rs. 2 lakh. Members can also invest in one-time shares up to Rs. 50,000 and make time-bound savings of up to Rs. 1 lakh.

Moreover, the Sahyog official mentioned the Haj and Umrah Account, which allows individuals planning to undertake the sacred pilgrimage to open an account with a minimum deposit of Rs. 200 per day or Rs. 5,000 per month. The term period for this account can range from 1 to 5 years, depending on the member’s needs.

Lauding Sahulat and Sahyog’s services for their focus on human care and the empowerment of low-income individuals, MP Tariq Anwar praised the society’s constructive work, highlighting its crucial impact on society. He commended the society’s interest-free loan schemes and financing programmes as a significant and commendable effort to assist those in need.

The MP said, “India is still not a developed country. We are still struggling to reach that goal. Even after 75 years of independence, our dream of a developed nation remains distant. It is a sad fact that around 90% of the population in this country is either poor or below the poverty line. Nearly 80 crore people depend on government rations or food.”

Urging people to work together and support initiatives like Sahyog to help elevate the country from poverty, Tariq Anwar emphasized the importance of cooperation. He reminded the audience that the cooperative movement in India began even before independence and has since become an integral part of the nation’s structure, with cooperatives playing key roles in different sectors including agriculture.

Lauding the progress of Sahulat and Sahyog, Prof. D.K. Dhusia, Head of the Department of Commerce and Business Studies at Jamia Millia Islamia, stated that microfinance is synonymous with empowerment. He emphasized that microfinance is particularly beneficial for small-scale businesses, noting that these cooperative societies operate interest-free, in alignment with Islamic banking principles that also function on a zero-interest basis. He highlighted that microfinance societies play a vital role in empowering low-income groups within society.

During the event, Dr. Majid Ahmed Talikoti, a renowned surgeon and chairman of the 600-bed Medicant Hospital and Research Centre in Bokaro, Jharkhand, made a significant announcement. He pledged to offer free OPD treatments to all members of Sahyog and provided a 50% discount on cancer treatments. Dr. Talikoti also committed to extending full support and assistance to Sahyog’s members at his hospital.

source: http://www.indiatomorrow.net / India Tomorrow / Home> Economy / by Anwarulhaq Baig / February 24th, 2025