INDIA :

Ahmeda Calcuttawala’s son in their manufacturing unit.

For Abdul Tayeb Saifee, a 58-year-old Bengaluru-based industrial adhesive manufacturer, surviving and supporting his family was the only priority after a major economic setback. During this trying time, when he could not get sufficient financial help from friends and family, Qardan Hasana helped him sustain and rebuild his life.

Qardan Hasana, literally translated as ‘the good loan’, is a Dawoodi Bohra institution that offers interest-free loans in keeping with the Islamic injunction to refrain from all forms of interest. The objective of this institution is to assist community members in improving housing and quality of life, supporting education and enabling business growth. Over the last 45 years, hundreds of Qardan Hasana branches have been set up throughout South Asia, where the majority of the Dawoodi Bohra community resides, and across the rest of the world.

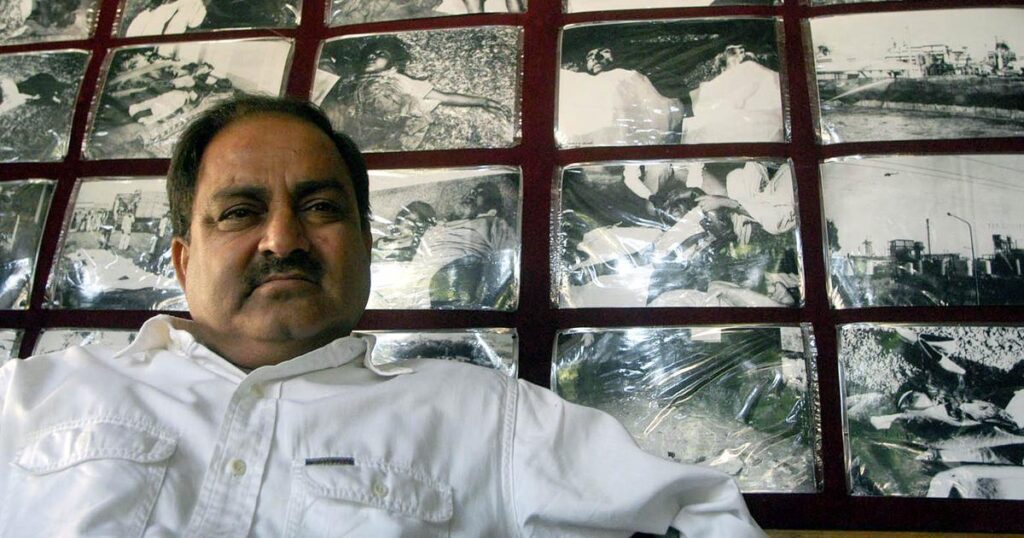

Abdul Tayeb from Bengaluru

“The timely loan was like an elixir, a single drop of water that revived me and gave me a new lease on life,” says Saifee. He adds that choosing to repay the loan instalments on time has instilled a sense of responsibility in him and motivated him to push beyond his comfort zone to work harder. He expresses gratitude to the late 52nd leader of the Dawoodi Bohra community Syedna Mohammed Burhanuddin, on his 11th death anniversary, for having established the Qardan Hasana institution in 1979.

The Working Mechanism

The primary contribution to any Qardan corpus is provided by Syedna of the time, currently by Syedna Mufaddal Saifuddin (the leader of the Dawoodi Bohra community), along with secondary contributions from local community members. The Syedna continues to infuse new funds, especially on important anniversaries or celebrations. His efforts to promote and implement the concept of Qardan Hasana inspire his followers to emulate him. There are no limitations to contribution; members can give as little or as much as they like according to their capacity. As a result, these organisations are well equipped to cater to the socio-economic needs of any community member.

Interest Loans – A slow death

Every other day we read stories about interest-bearing loans that resulted in unpayable debts and bankruptcy or people feeling buried, almost as long as they live while paying off their interest on housing or education loans. The economic effects of the pandemic and period of extreme global banking systems have exacerbated the lives and livelihoods of millions across the globe. However, studies have shown how important cash reserves are in times of uncertainty, as well as for fostering future growth

Qardan Hasana – Fuelling entrepreneurship and growth

Ahmed Calcuttawala, 94, owns a marine supplies business in Kolkata. For his capital-intensive nature of the business, he requires a regular infusion of cash which he avails from the Kolkata Qardan Hasana office. This, he says, “proved highly beneficial for my working capital especially during and post pandemic business recovery.”

Three generations of Calcuttawala family

He recalled a recent incident while bidding for an order from the Ministry of Defence for which heavy investment was required. They were offered loan options from the bank however, Ahmed chose to raise money from Qardan Hasana to fulfil his order.

Ranging from large-scale amounts for industrial and commercial growth, to small-scale amounts to venture into businesses, Qardan Hasana has provided aspiring entrepreneurs with the financial wings they need to soar. “With the support of money I received, I was able to turn my dream into reality,” shares 32-year-old Zahra Aliasgar, a teacher from Coimbatore who transitioned from working in a private school to starting her own kindergarten. “The institution’s assistance gave me the confidence and resources to pursue my ambitions without the burden of interest.”

source: http://www.thecognate.com / The Cognate / Home> Business / by The Cognate News Desk / September 18th, 2024